The Overseas Acquisition and Merger Risk Seminar is Smoothly Held in 2017

In the afternoon of September 13, the 2017 Overseas Acquisition and Merger Risk Seminar was held smoothly in the Point-Line Space Professional Service Exchange Center, Futian District. It was sponsored by the Economic, Trade and Information Commission of Shenzhen Municipality , organized by the Shenzhen Outbound Alliance and co-sponsored by the Statistical Society for Foreign Economic Relations and Trade of Shenzhen. Nearly 100 representatives attended the meeting, including Zhou Xiaohong, Investigator of the Foreign Cooperation Division of Economic, Trade and Information Commission of Shenzhen Municipality, Sun Tianlu, Vice Chairwoman and Secretary General of the Alliance, Lin Jie, Director of the Project Insurance Management Department of Sinosure, Mai Haosheng, International Tax Consultancy Partner of Ernst & Young, Bai Guanglin, Senior Partner of Yingke Law Firm, Ren Xiaoqiang, Deputy General Manager of the High-end Liability Insurance Business Department of Pingan Property Insurance as well as representatives of Shenzhen Energy, Beijing Genomics Institute, Holpe, China Mechants Capital,Han’s Group, Doctor Glasses, etc.

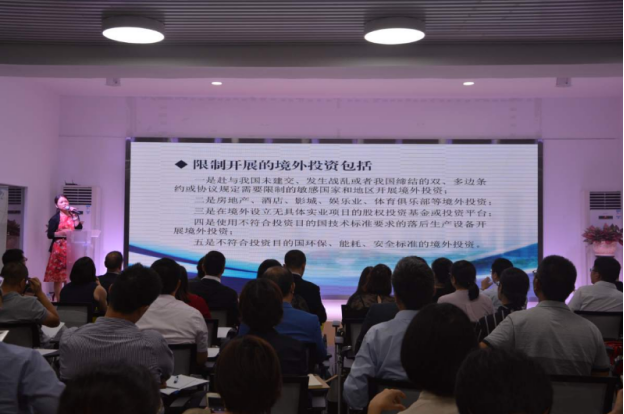

Firstly, Zhou Xiaohong, Investigator of the Foreign Cooperation Division of Economic, Trade and Information Commission of Shenzhen Municipality, introduced Shenzhen’s policies, laws and regulations about enterprises’ overseas investment, the general direction of overseas investment encouragement, relevant fields in which investment had been banned, filing process, relevant financial aid policies and other contents closely related to enterprises.

Later on, Lin Jie, Director of the Project Insurance Management Department of Sinosure, shared the way in which enterprises should deal with the acquisition and merger capital chain risk of overseas investment. Lin also introduced the policy export credit insurance to the audience with multiple overseas acquisition and merger cases as well as the acquisition and merger operation and risk.

Ren Xiaoqiang, Deputy General Manager of the High-end Liability Insurance Business Department of Pingan Property Insurance, shared the management of Chinese cross-border acquisition and merger risk. Ren explained to the audience how to carry out risk management with such cases as risk tendencies in previous cross-border acquisition and merger, risk solutions, compensation insurance, etc.

Mai Haosheng, International Tax Consultancy Partner of Ernst & Young, shared some issues concerning the taxes for overseas investment and acquisition and merger. Mai explained to the audience the tax challenges frequently occurring in the current overseas investment and acquisition and merger and the potential tax risk frequently occurring in contracts.

Bai Guanglin, Senior Partner of Yingke Law Firm, shared the legal risks and precautionary measures of overseas investment and acquisition and merger. Bai analyzed any legal risks possibly existing during overseas investment and acquisition and merger and how they should be dealt with.

Liang Qiurong, Senior Manager of the Policy Research Department of Statistical Society for Foreign Economic Relations and Trade of Shenzhen, shared our city’s current funding policies for overseas investment, and explained in details the industrial scope covered by Shenzhen’s overseas investment support policies, the modes of support and declaration and so on.

Communication after conference

Under the current general tendency that domestic enterprises are accelerating the implementation of their “outbound plans”, there are great opportunities for enterprises to develop the overseas business, and meanwhile, the risks in overseas investment and acquisition and merger are high. Implementing the “outbound plan” is a high-risk and professionalized strategic activity, so well planning laws and taxes, managing and controlling risks, etc. can prevent enterprises from taking a wrong path, help them rapidly be integrated into the overseas market and is of great significance to the enterprises implementing their outbound plans. To make enterprises more deeply learn the overseas investment and acquisition and merger, the meeting provided them with the analyses on policies, insurance, finance and taxation, laws, etc., passed on experience to them from actual cases, and helped them with finding appropriate policy connection. The content of seminar was professional and practical and was high praise by the enterprises.