Seminar on the Latest Tax Policy and Regulation Trends and Development in India and US

On the afternoon of May 7, Seminar on the Latest Tax Policy and Regulation Trends and Development in India and US, co-hosted by Shenzhen Outbound Alliance (SOA) and Ernst & Young Global Limited (China), the Vice President Entity of Statistical Society for Foreign Economic Relations and Trade of Shenzhen, organized by Roadlink GLB and co-organized by Statistical Society for Foreign Economic Relations and Trade of Shenzhen, was held successfully at Point-line Space Professional Service Exchange Center in Shenzhen.

The Seminar was hosted by Zhou Gang, Director of Roadlink GLB. Feng Xiangyang, Director of Shenzhen Futian Enterprise Development Service Center, Sun Tianlu, Executive Chairman of SOA and President of Statistical Society for Foreign Economic Relations and Trade of Shenzhen, and Mai Haosheng, Partner of Ernst & Young Global Limited (China) attended it as guests. The representatives from almost one hundred enterprises such as Coolpad Group Limited, Skyworth Group, TCL, Han’s Laser Technology CO., LTD. ect., participated in this event.

Feng Xiangyang, Director of Shenzhen Futian Enterprise Development Service Center, attended the Seminar and delivered a speech. He said, as the downtown of Shenzhen, Futian District would receive nearly 600 million yuan of special funds in 2018 to guide its industrial development and provide solid support for achieving its medium and long-term industrial development plans, and welcome more enterprises and professional institutes to Futian for further development.

Mai Haosheng, Tax Service Partner of Ernst & Young Global Limited (China), also delivered his speech on the Seminar; Gagan Malik, Tax Service Partner of Ernst & Young (India), presented the impact brought by India's fifth edition of the budget proposal on multinational groups with tax obligations and the update of India's important tax systems and regulations; Christine Jones from US, Senior Manager of Ernst & Young (Hong Kong) , probed into the new tax reform in the United States and focused on new anti-deferral provisions and new minimum base erosion anti-avoidance tax (BEAT) in the United States .

Gagan Malik, Tax Service Partner of Ernst & Young (India), said that as a member state of BRIC, India had implemented two basic reforms over the past year or so in Asia, stopping the circulation of two old versions of high-par-value currencies and levying GST. The economy also showed upbeat growth in the second quarter from its lower growth rate in the previous quarter, reaching 6.3%, while manufacturing was also growing at an accelerated pace. The World Bank's ‘Doing Business Convenience’ index included India among the top 100 countries for the first time, and its government is trying to make it one of the top 50 countries as soon as possible. Under this context, the Minister of Finance of India submitted the fifth edition of the budget bill on February 1, 2018, which will have a significant impact.

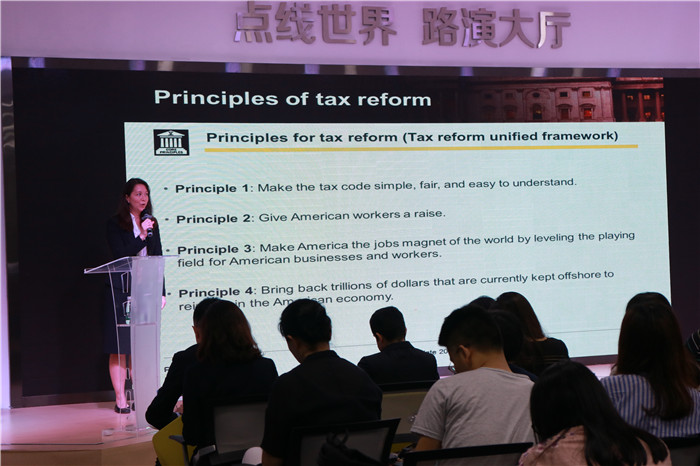

On December 22, 2017, US President Trump formally signed and approved the Tax Cuts and Jobs Act, said Christine Jones, Senior Manager of Ernst & Young (Hong Kong). So far, the high-profile US tax reform, the most comprehensive one in the United States for nearly more than 30 years, is expected to have a profound impact on most US taxpayers, including U.S. multinational groups and non-US multinational groups operating in the U.S..

The Act has made many changes to the current tax system in the United States, and as far as corporate income tax is concerned, the main provisions include: firstly, the corporate federal income tax rate fell from 35% to 21%; secondly,the 13.125% tax rate is applied to the foreign intangible income of United States companies; thirdly, The profits of foreign affiliates of US multinational groups are treated as tax-free when they are remitted back to the United States under certain conditions; fourthly, new anti-deferral provisions are introduced to ensure that income from intangible assets estimated by controlled foreign enterprises is taxed at the minimum rate of US and/or foreign taxes; fifthly, a minimum base erosion anti-avoidance tax (BEAT) will be newly imposed based on the total deductible fees paid by any enterprise to its overseas affiliated enterprise for the current year; sixthly, the deductible net interest fee will be limited at 30% of the adjusted income (refers to EBITDA as of 2021 and EBIT thereafter); seventhly, a one-time transition tax is levied on overseas deferred earnings, with an overseas deferred benefit tax rate of 15.5% held in the form of current assets and a tax rate of 8% in other manners.

At the end of the Seminar, the representatives of each company had a lively interactive exchange with the tax services experts from Ernst & Young on issues related to corporate investment and taxation in India and the United States. The main purpose of this Seminar was to provide enterprises with the latest information on overseas tax policies and regulations, and to set up a consultation platform for enterprises interested in investing abroad or having overseas business, which provided solid support for those enterprises who have already ‘go globalized’.